INSIGHTS &

REPORTS

Market Update

The IPO market was hot in June

The total number of listings in June kept rising in comparison to the ten initial public offerings (IPOs) in May. This month, fifteen new stocks were listed on HKEX, and the overall IPO market was performing well. As of June 30th, TRANSTHERA-B (2617.HK) and ZHOU LIU FU (6168.HK) saw a 129% and 102% increase in share price, respectively, since listing. Whereas METALIGHT (2605.HK) and ETERNAL BEAUTY (6883.HK) saw a 37% and 29% decrease in share price since listing, respectively.

Phillip Hong Kong Newly Listed Equities Index ETF (2835.HK)

The ETF aims to fully replicate the Solactive Hong Kong Newly Listed Equities Index, a rules-based equity benchmark designed to track the performance of securities that had a recent initial public offering or new listing on the main board of HKEX. The index is rebalanced quarterly, incorporating securities with IPOs or new listings within the last 756 business days, aiming for a total of 50 securities based on free-float market capitalization. The index also undergoes monthly IPO reviews to include recent IPOs, subject to liquidity and market capitalisation criteria.

June Monthly Review

Solactive HK Newly listed Equities Index included CATL (3750.HK), DUALITYBIO-B (9606.HK), ZENERGY (3677.HK), BEAUTYFARM MED (2373.HK), TS LINES (2510.HK), WELLCELL HOLD (2477.HK), STARPLUS LEGEND (6683.HK), RIMAG GROUP (2522.HK), and VOICECOMM (2495.HK) in June through the quarterly rebalancing mechanism. And it also removed NIO-SW (9866.HK), LEPU BIO-B (2157.HK), SUPER HI (9658.HK), FENBI (2469.HK), MINIEYE (2431.HK), AUTOSTREETS (2443.HK), HUITONGDA NET (9878.HK), and IMOTIONTECH (1274.HK). The current number of constituent stocks has increased from 49 to 50.

CATL (3750.HK) is a globally leading innovative new energy technology company, which is primarily engaged in the research, development, production, and sales of EV batteries and ESS batteries. The company promotes the transition from mobile and stationary fossil energy sources to sustainable alternatives, as well as creating integrated innovative solutions for new applications through advancements in electrification and intelligent technologies. As of December 31st, 2024, the company’s EV batteries were installed in over 17 million vehicles, and its ESS batteries were deployed in over 1,700 projects across the globe, representing the broadest coverage of customer and end-user base globally.

As of December 31st, 2024, the company’s revenue in 2024 was 362.01 billion yuan (RMB, the same below), a year-on-year decrease of 9.7%. Gross profit was 88.49 billion, an increase of 15.0% YoY; the gross profit margin rose from 19.2% in 2023 to 24.4% in 2024. The profit for the year attributable to the company’s equity holders was 52.03 billion, an increase of 16.4% YoY. This year, the company’s revenue decreased, but profits continued to grow, mainly benefiting from the advantages of innovative products. Although the average sales price of battery systems has been reduced due to the decline in prices of raw materials such as lithium carbonate, the unit profitability of the company’s battery systems remained stable despite the decline in the average sales price, thereby driving an increase in gross profit margin.

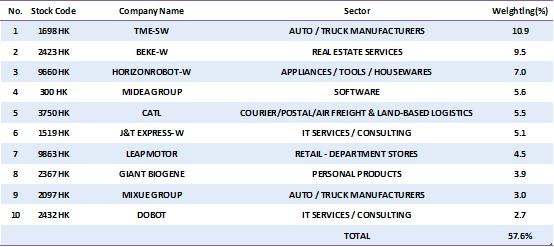

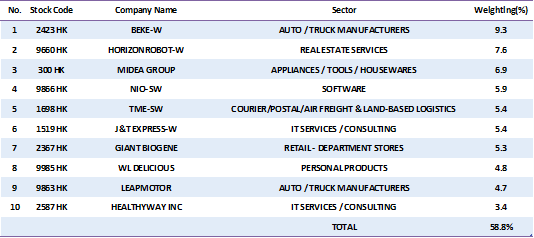

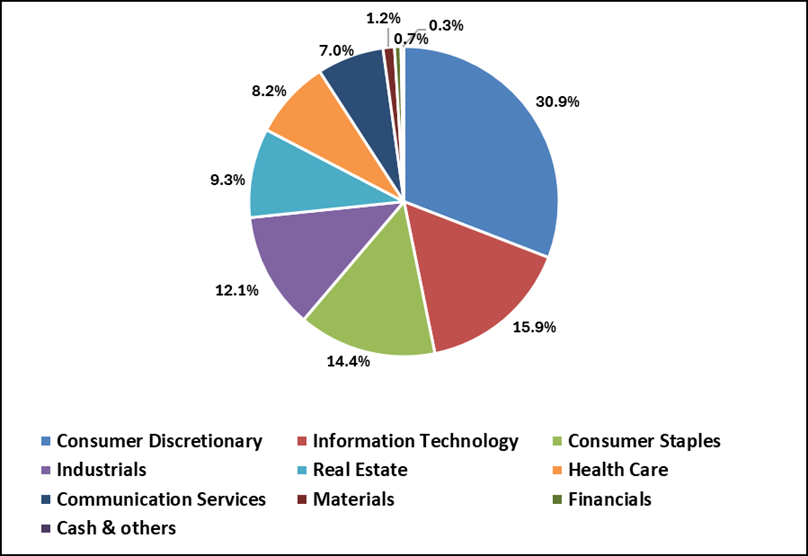

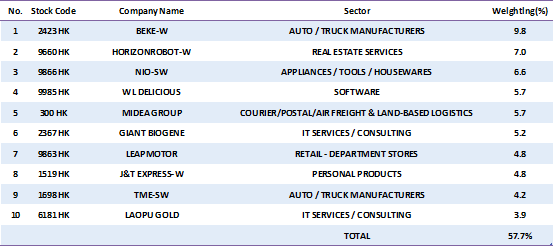

Top 10 Holdings

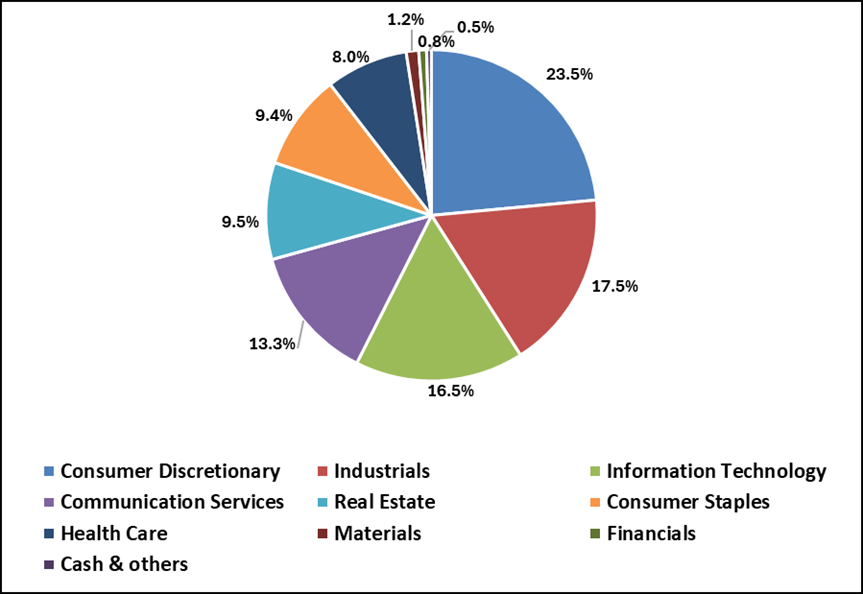

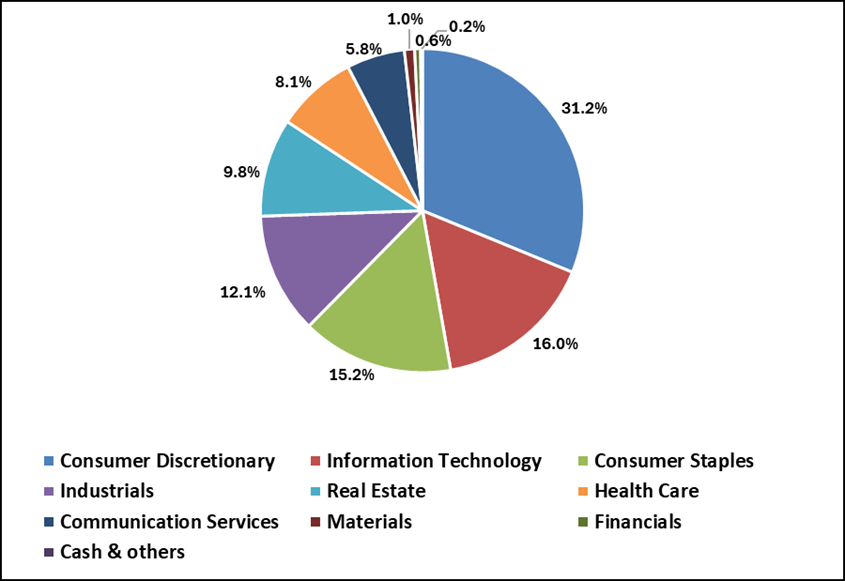

This month, the Solactive Hong Kong Newly Listed Equities Index’s top ten holdings changed. Among the top ten holdings in May, NIO-SW (9866.HK) was removed from the quarterly rebalancing because it has been listed for more than three years, WL DELICIOUS (9985.HK) and HEALTHYWAY INC (2587.HK) also fell out of the top ten holdings due to market fluctuations, while CATL (3750.HK), MIXUE GROUP (2097.HK), and DOBOT (2432.HK) became the new top ten holdings. The following industries are currently the focus of the index: consumer discretionary (including MIDEA, LEAPMOTOR, and MIXUE GROUP), industrials (including CATL, J&T EXPRESS-W, and DOBOT), and information technology (including HORIZON ROBOT, KINGSOFT CLOUD, and FOURTH PARADIGM). The following figures show the top 10 holdings and sector breakdown of the Phillip HK Newly Listed Equities Index:

Key Components Update

- TME-SW (1698.HK): In June, TME announced that it intends to acquire the online audio platform Himalaya for a consideration of 1.26 billion USD in cash, and Himalaya will become a wholly owned subsidiary of TME. The transaction is still subject to regulatory approval. In addition, TME and TVB announced they would deepen their all-round strategic cooperation in entertainment and music in the Greater Bay Area. The two parties will focus on integrating resources such as music, technology, user ecology, film and television IP, mainland and Hong Kong, Macao and overseas channels, and explore the innovative ecological model of “music + film and television + technology”.

- BEKE-W (2423.HK): On June 18th, China Merchants Shekou and Beihaojia signed a strategic cooperation framework agreement in Shenzhen, marking that the two parties will carry out in-depth cooperation in the field of real estate development. According to the agreement, China Merchants Shekou and Beihaojia will actively promote real estate development project cooperation that is in line with the development strategies of both parties, focusing on residential cooperation, while considering other formats such as commercial. The cooperation methods are diverse, including equity cooperation and cooperation on light asset projects. The two parties will also cooperate to develop projects and actively give play to their professional expertise to provide value-added services such as development management, product positioning, design, and marketing for the projects.

- HORIZON ROBOT-W (9660.HK): Horizon Robot brought its urban assisted driving system, Horizon SuperDrive (HSD), and the in-vehicle intelligent computing solution Journey 6 series to the 2025 First International Automotive and Supply Chain Expo at the Hong Kong AsiaWorld-Expo for the first time. The company fully demonstrated its full-stack technology achievements combining software and hardware, showing the future direction and practical path of intelligent driving technology to the world. As the core exhibit of this exhibition, HSD won the “Innovation Achievement” award awarded by the conference for its “human-like” driving experience and reliable technical performance.

- MIDEA GROUP (300.HK): During the 618 promotion period, the sales of household appliances reached 110.1 billion yuan (RMB, the same below), an increase of about 45.6% year-on-year, significantly leading the overall e-commerce growth rate of 15.2% in the market. The core driving force comes from the platform’s simplified promotion rules and the superposition of national subsidies and platform subsidies. Content platforms such as Xiaohongshu and e-commerce platforms work together to promote the explosion of consumer demand. During the promotion period, Midea’s total online sales ranked first in the industry, with retail sales increasing by more than 20% year-on-year, and COLMO’s retail sales increasing by more than 85% year-on-year. Looking ahead to the third and fourth quarters, the national subsidies will orderly distribute the remaining 138 billion of funds to boost consumer sentiment.

- CATL (3750.HK): In an interview with the Financial Times, Jiang Li, secretary of the board of directors of CATL, said that the company hopes to promote its battery replacement and recycling technology to Europe. Jiang said that battery replacement technology, which allows electric car drivers to replace depleted batteries with fully charged batteries, has great potential in Europe and can make batteries cheaper and more durable. CATL hopes to build 1,000 battery replacement stations in China by the end of the year and 10,000 stations within three years and plans to replicate this business model in Europe and other regions. The group has discussed the possibility of using this technology in Europe with automakers.

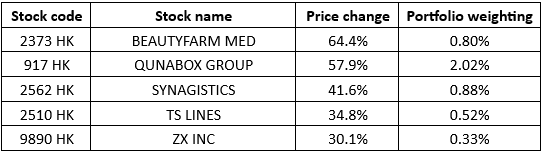

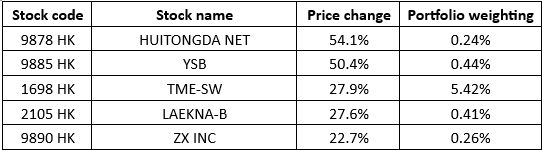

Top constituent movers in June:

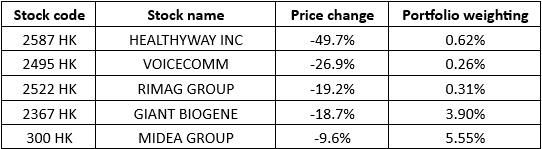

Bottom constituent movers in June:

The Phillip HK Newly Listed Index ETF (2835.HK) monthly performance for June

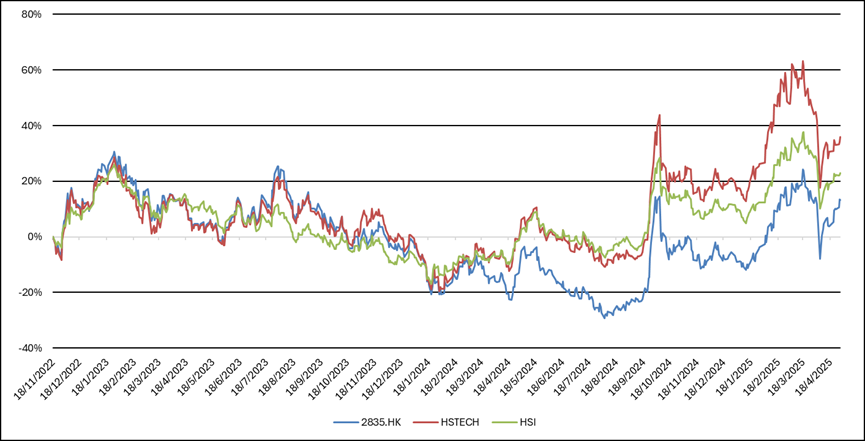

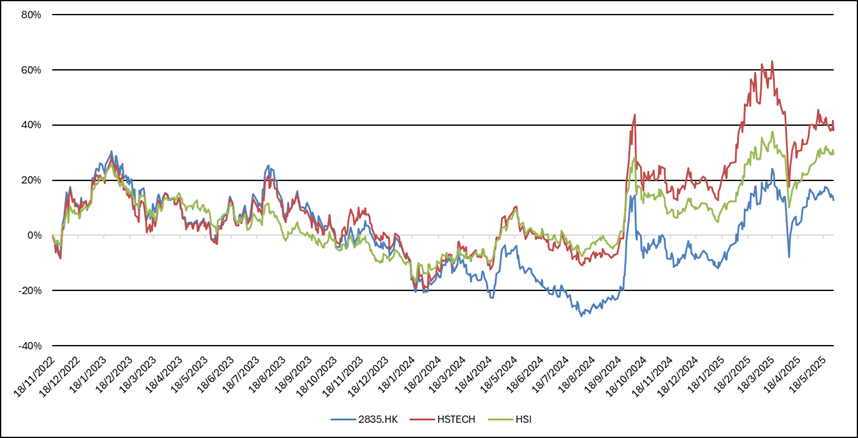

The Phillip HK Newly Listed Index ETF (2835.HK) recorded a 1.15% monthly increase in June, underperforming the Hang Seng Index’s (HSI) 3.36% monthly increase and the Hang Seng Tech Index’s (HSTI) 2.56% monthly increase. As of June 30th, this ETF had grown 14.07% since its listing, underperforming the HSI’s rise of 33.79% and the HSTI’s rise of 41.68%.

The IPO market was hot in May

The total number of listings in May rose significantly in comparison to the two initial public offerings (IPOs) in April. This month, ten new stocks were listed on HKEX, and the overall IPO market was performing well. As of May 31st, BRETON (1333.HK) and HENGRUI PHARMA (1276.HK) saw a 71% and 32% increase in share price, respectively, since listing. Whereas PEGBIO CO-B (2565.HK) and SHOUHUI GROUP (2621.HK) saw a 35% and 18% decrease in share price since listing, respectively.

Phillip Hong Kong Newly Listed Equities Index ETF (2835.HK)

The ETF aims to fully replicate the Solactive Hong Kong Newly Listed Equities Index, a rules-based equity benchmark designed to track the performance of securities that had a recent initial public offering or new listing on the main board of HKEX. The index is rebalanced quarterly, incorporating securities with IPOs or new listings within the last 756 business days, aiming for a total of 50 securities based on free-float market capitalization. The index also undergoes monthly IPO reviews to include recent IPOs, subject to liquidity and market capitalisation criteria.

May Monthly Review

In May, the Solactive Hong Kong IPO Index included MIXUE GROUP (2097.HK) through the fast-track mechanism and removed LAOPU GOLD (6181.HK), VISEN PHARMA-B (2561.HK), and AIM VACCINE (6660.HK). The current number of constituent stocks has decreased from 51 to 49.

MIXUE GROUP (2097.HK) is a leading freshly-made drinks company and is committed to providing value-for-money products to consumers, including freshly-made fruit drinks, tea drinks, ice cream and coffee, typically priced around approximately 6 RMB per item. Through a franchise model, the company has cultivated a network of over 45,000 stores spanning China and 11 overseas countries as of September 30th, 2024. The company is the largest freshly-made drinks company both in China and worldwide in terms of the number of stores, according to data.

As of December 31st, 2023, the company’s revenue in 2023 was 20,302 million yuan (RMB, the same below), a year-on-year increase of 49.6%. Gross profit was 5,999 million, an increase of 55.9% YoY; the gross profit margin rose from 28.3% in 2022 to 29.5% in 2023. The profit for the year attributable to the company’s equity holders was 3,137 million, an increase of 57.1% YoY. Factors such as the increase in consumer demand for freshly made beverages, the expansion of the store network, the ability to manage the store network, scaling and efficient supply chain capabilities have directly driven the company’s sustainable growth in revenue and profits.

Top 10 Holdings

This month, the Solactive Hong Kong Newly Listed Equities Index’s top ten holdings changed. LAOPU GOLD (6181.HK) was removed from the index, while HEALTHYWAY INC (2587.HK) became the new top ten holdings of the month. The following industries are currently the focus of the index: consumer discretionary (including MIDEA, NIO, and LEAPMOTOR), information technology (including HORIZON ROBOT, KINGSOFT CLOUD, and ROBOSENSE), and consumer staples (including GIANT BIOGENE, WL DELICIOUS, and MAO GEPING). The following figures show the top 10 holdings and sector breakdown of the Phillip HK Newly Listed Equities Index:

Key Components Update

- BEKE-W (2423.HK): According to data, BEKE’s total transaction volume in the first quarter of 2025 was 843.7 billion yuan (RMB, the same below), an increase of 34.0% year-on-year. Net revenues were 23.3 billion, an increase of 42.4% year-on-year. Gross profit increased by 17.0% from 4.1 billion in the same period of 2024 to 4.8 billion in Q1 2025; gross profit margin decreased from 25.2% in the same period of 2024 to 20.7% in Q1 2025. Net income was 855 million, an increase of 97.9% year-on-year.

- HORIZON ROBOT-W (9660.HK): According to data, the delivery volume of Horizon Robot’s product solutions reached 2.9 million pieces in 2024, and the cumulative delivery volume reached 7.7 million pieces. The company ranked first in the market share of ADAS all-in-one machines in 2024, and the “smart driving equality” in 2025 is expected to drive the cumulative shipments of hardware to exceed 10 million. In 2024, the company ranked first in the market share of front-view integrated computer solutions for independent brand passenger cars in the Chinese market; it ranked second among independent suppliers of high-end autonomous driving solutions for Chinese partners.

- MIDEA GROUP (300.HK): On May 16th, Hang Seng Indexes Co., Ltd. (“Hang Seng Indexes”) announced the results of the quarterly review of the Hang Seng Index series as of March 31st, 2025. Midea Group will be included in the Hang Seng Index constituent stocks. The change will be implemented after the close of trading on June 6th, 2025 (Friday) and will take effect on June 9th, 2025 (Monday).

- NIO-SW (9866.HK): According to the May delivery data released by Nio, the company delivered 23,231 new vehicles this month, with a 13.1% year-over-year increase. The deliveries consisted of 13,270 vehicles from the company’s premium smart electric vehicle brand NIO, 6,281 vehicles from the company’s family-oriented smart electric vehicle brand ONVO, and 3,680 vehicles from the company’s small smart high-end electric car brand FIREFLY. As of the end of May 2025, Nio delivered a total of 89,225 vehicles this year, with a 34.7% year-over-year increase, and a total of 760,789 vehicles to date.

- TME-SW (1698.HK): According to data, TME’s total revenue in the first quarter of 2025 was 7.36 billion yuan (RMB, the same below), an increase of 8.7% year-on-year, mainly due to the strong year-on-year growth in the company’s online music service revenue, which was partially offset by the decline in social entertainment services and other service revenues. Gross profit increased by 14.3% to 3.2 billion from 2.8 billion in the same period of 2024; gross profit margin increased from 40.9% in the same period of 2024 to 44.1%.

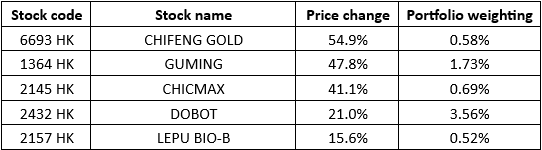

Top constituent movers in May:

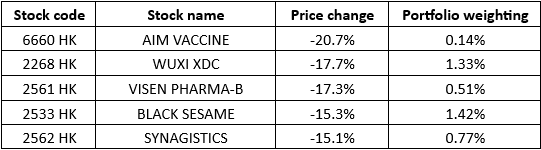

Bottom constituent movers in May:

The Phillip HK Newly Listed Index ETF (2835.HK) monthly performance for May

The Phillip HK Newly Listed Index ETF (2835.HK) recorded a 0.41% monthly decrease in May, underperforming the Hang Seng Index’s (HSI) 5.29% monthly increase and the Hang Seng Tech Index’s (HSTI) 1.63% monthly increase. As of May 31st, this ETF had grown 12.77% since its listing, underperforming the HSI’s rise of 29.44% and the HSTI’s rise of 38.15%.

The IPO market did not perform well in April

The total number of listings in April dropped significantly in comparison to the six initial public offerings (IPOs) in March. This month, only two new stocks were listed on HKEX, but the overall IPO market was performing well. As of April 30th, DUALITYBIO-B (9606.HK) and ZENERGY (3677.HK) saw a 119% and 1% increase in share price, respectively, since listing.

Phillip Hong Kong Newly Listed Equities Index ETF (2835.HK)

The ETF aims to fully replicate the Solactive Hong Kong Newly Listed Equities Index, a rules-based equity benchmark designed to track the performance of securities that had a recent initial public offering or new listing on the main board of HKEX. The index is rebalanced quarterly, incorporating securities with IPOs or new listings within the last 756 business days, aiming for a total of 50 securities based on free-float market capitalization. The index also undergoes monthly IPO reviews to include recent IPOs, subject to liquidity and market capitalisation criteria.

April Monthly Review

In April, the Solactive Hong Kong IPO Index included CHIFENG GOLD (6693.HK) and VISEN PHARMA-B (2561.HK) through the fast-track mechanism and removed WELLCELL HOLD (2477.HK). The current number of constituent stocks has increased from 50 to 51.

CHIFENG GOLD (6693.HK) is principally engaged in the mining, processing, and sale of gold. The company owned and operated seven gold and polymetallic mines across the world, including China, Southeast Asia, and West Africa. According to the report, the company experienced the fastest growth among major gold producers in China from 2021 to 2023, with a CAGR of 33.1% in gold production over that period. Also, the company had the greatest overseas presence in terms of both overseas assets and revenue contribution among gold producers in China as of the end of the year 2023.

As of December 31st, 2023, the company’s revenue in 2023 was 7,221.0 million yuan (RMB, the same below), a year-on-year increase of 15.2%. Gross loss was 2,352.9 million, an increase of 31.1% YoY; the gross loss margin rose from 28.6% in 2022 to 32.6% in 2023. The profit for the year attributable to the company’s equity holders was 804.5 million, an increase of 78.4% YoY. The increase in the company’s revenue is directly related to the increase in the gold and non-ferrous metal prices and demand in end markets, the increase in production through the acquisition of new mining areas, the decrease in sales costs and increase in recovery rates, and the exchange rate fluctuations.

Top 10 Holdings

This month, the Solactive Hong Kong Newly Listed Equities Index’s top ten holdings changed. DOBOT (2432.HK) fell out of the top ten holdings due to market movement, while WL DELICIOUS (9985.HK) became the new top ten holdings of the month. The following industries are currently the focus of the index: consumer discretionary (including NIO, MIDEA, and LEAPMOTOR), information technology (including HORIZON ROBOT, KINGSOFT CLOUD, and ROBOSENSE), and consumer staples (including WL DELICIOUS, GIANT BIOGENE, and MAO GEPING). The following figures show the top 10 holdings and sector breakdown of the Phillip HK Newly Listed Equities Index:

Key Components Update

- BEKE-W (2423.HK): According to the 2024 annual report announced by BEKE, the company’s number of stores is 51,573, an increase of 17.7% from 2023. And the number of active stores is 49,693, an increase of 18.3% from 2023. The company has 499,937 brokers, a year-on-year increase of 16.9%. And the number of active brokers is 445,271, a year-on-year increase of 12.1%. In the fourth quarter of 2024, the number of mobile monthly active users averaged 43.2 million, compared with 43.2 million in the same period of 2023.

- HORIZON ROBOT-W (9660.HK): According to the 2024 audited annual report released by Horizon Robot, the company’s product solution delivery volume reached 2.9 million units in 2024, with more than 100 new models added throughout the year, and the total number of models added exceeded 310. At the same time, HSD high-level autonomous driving solutions have obtained integration intentions from multiple leading OEMs. The company expects that the cumulative shipments of the Journey series chips will exceed 10 million pieces in 2025, marking that it is expected to become the first domestic autonomous driving chip company to enter the 10 million level.

- NIO-SW (9866.HK): According to the April delivery data released by Nio, the company delivered 23,900 new vehicles this month, with a 53.0% year-over-year increase. The deliveries consisted of 19,269 vehicles from the company’s premium smart electric vehicle brand NIO, 4,400 vehicles from the company’s family-oriented smart electric vehicle brand ONVO, and initial deliveries of the company’s small smart high-end electric car brand FIREFLY, which started in late April 2025. As of the end of April 2025, Nio delivered a total of 65,994 vehicles this year, with a 44.5% year-over-year increase, and a total of 737,558 vehicles to date.

- WL DELICIOUS (9985.HK): According to the 2024 annual report released by WL Delicious, the group’s overall revenue for the year was 6,266.3 million (RMB, the same below), an increase of 28.6% YoY. Gross profit was 3,016.1 million, an increase of 29.9% YoY. The gross profit margin was 48.1%, an increase of 0.4% over the previous year’s 47.7%. Net profit was 1,068.1 million, up 21.3% from the previous year.

- MIDEA GROUP (300.HK): According to the financial report released by Midea Group as of March 31st, 2025, the revenue in 2025 Q1 was 127.838 billion (RMB, the same below), an increase of 20.49% YoY. Compared with the 9% YoY growth in the overall revenue in 2024 Q4, the quarter-on-quarter growth rate was also significantly accelerated. The net profit in 2025Q1 was 12.422 billion, an increase of 38% YoY; the net profit after deducting non-recurring items in 2025Q1 also increased 38% YoY to 12.75 billion.

Top constituent movers in April:

Bottom constituent movers in April:

The Phillip HK Newly Listed Index ETF (2835.HK) monthly performance for April

The Phillip HK Newly Listed Index ETF (2835.HK) recorded a 0.95% monthly increase in April, outperforming the Hang Seng Index’s (HSI) 4.33% monthly decrease and the Hang Seng Tech Index’s (HSTI) 5.70% monthly decrease. As of April 30th, this ETF had grown 13.23% since its listing, underperforming the HSI’s rise of 22.94% and the HSTI’s rise of 35.93%.