INSIGHTS &

REPORTS

Market Update

The IPO market performance in December

Compared with the twelve new stocks listed on HKEX in November, the number of new listings rose significantly in December to 25 new stocks listed on HKEX. As of December 31st, the overall performance of the IPO market was divided. Among them, NUOBIKAN (2635.HK) and QINGSONG HEALTH (2661.HK) saw a 368% and 202% increase in share price, respectively, since listing. Whereas B&K CORP-B (2396.HK) and BENQ HOLDING (2581.HK) saw a 58% and 56% decrease in share price since listing, respectively.

Phillip Hong Kong Newly Listed Equities Index ETF (2835.HK)

The ETF aims to fully replicate the Solactive Hong Kong Newly Listed Equities Index, a rules-based equity benchmark designed to track the performance of securities that had a recent initial public offering or new listing on the main board of HKEX. The index is rebalanced quarterly, incorporating securities with IPOs or new listings within the last 756 business days, aiming for a total of 50 securities based on free-float market capitalization. The index also undergoes monthly IPO reviews to include recent IPOs, subject to liquidity and market capitalisation criteria.

December Monthly Review

Solactive HK Newly listed Equities Index included PONY-W (2026.HK), PEGBIO CO-B (2565.HK), WERIDE-W (800.HK), TRANSTHERA-B (2617.HK), MININGLAMP-W (2718.HK), CHUANGXIN IND (2788.HK), SERES (9927.HK), WELLCELL HOLD (2477.HK), SOFTCARE (2698.HK), MIRXES-B (2629.HK), and YUNJI (2670.HK) in December through the quarterly rebalancing mechanism. And it also removed TME-SW (1698.HK), LEAPMOTOR (9863.HK), CHERY AUTO (9973.HK), GIANT BIOGENE (2367.HK), BOSS ZHIPIN-W (2076.HK), CALB (3931.HK), CTG DUTY-FREE (1880.HK), BLOKS (325.HK), LEADS BIOLABS-B (9887.HK), ZJLD (6979.HK), SUNSHINE PHARMA (6887.HK), ZENERGY (3677.HK), CAOCAO INC (2643.HK), QUNABOX GROUP (917.HK), INNOGEN-B (2591.HK). The current number of constituent stocks has decreased from 54 to 50.

PONY-W (2026.HK) has been committed to developing advanced Level 4 autonomous driving technology, with a focus on autonomous driving mobility services. The company is the only Level 4 autonomous driving technology company to have obtained all regulatory permits available and required to provide public-facing robotaxi services in all four Tier-1 cities as of the Latest Practicable Date, operating a fleet of over 720 self-owned robotaxis as of the same date, which accumulated over 48.6 million kilometres of autonomous driving mileage, including over 11.5 million kilometres of driverless mileage. The company is also the first in China to receive approval for driverless robot truck platooning tests on cross-provincial highways in December 2024, operating a fleet of over 170 self-owned and leased robot trucks as of the Latest Practicable Date.

As of December 31st, 2024, the company’s revenue in 2024 was 75.0 million dollars (USD, the same below), a year-on-year increase of 4.3%. Gross profit was 11.4 million, a decrease of 32.5% YoY, due to the increase in cost of revenue exceeding the increase in revenue; the gross profit margin decreased from 23.5% in 2023 to 15.2% in 2024. The loss attributable to the company’s equity holders in 2024 was 275.0 million, an increase of 119.5% YoY, mainly due to a significant increase in operating expenses resulting from increased R&D investment to support the joint development of the seventh-generation autonomous taxi with OEM partners.

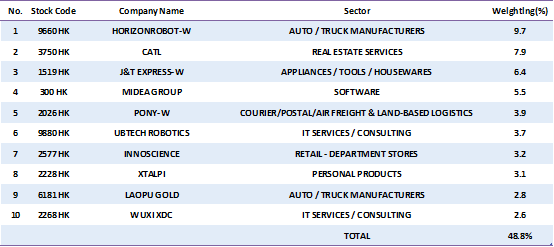

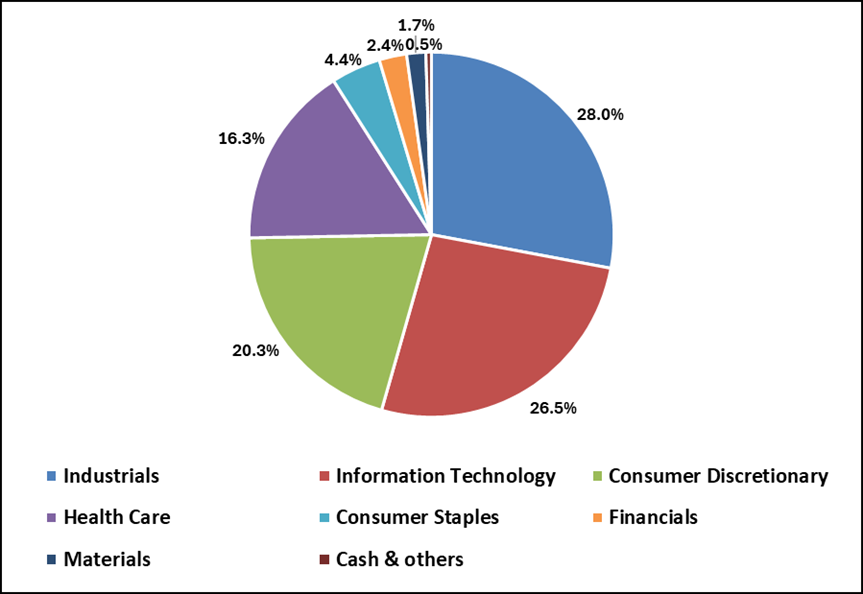

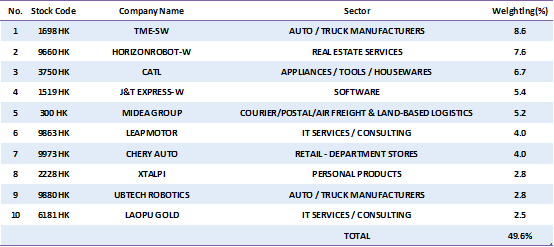

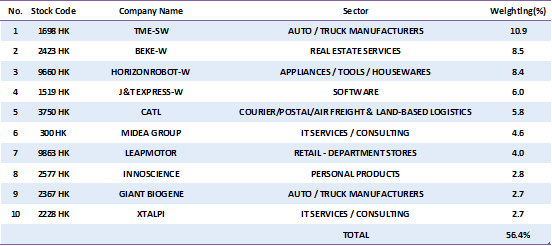

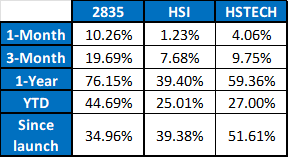

Top 10 Holdings

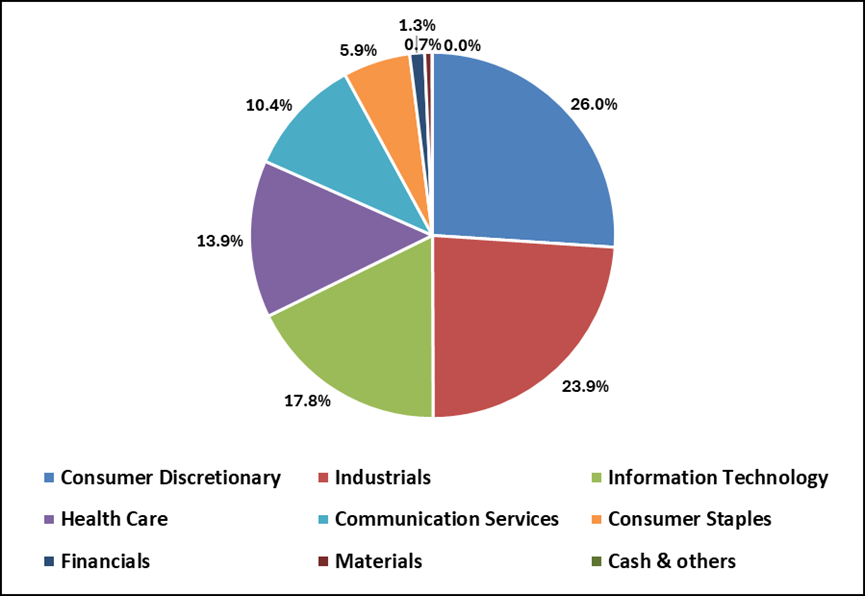

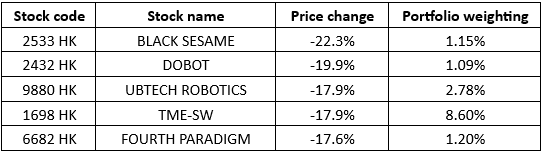

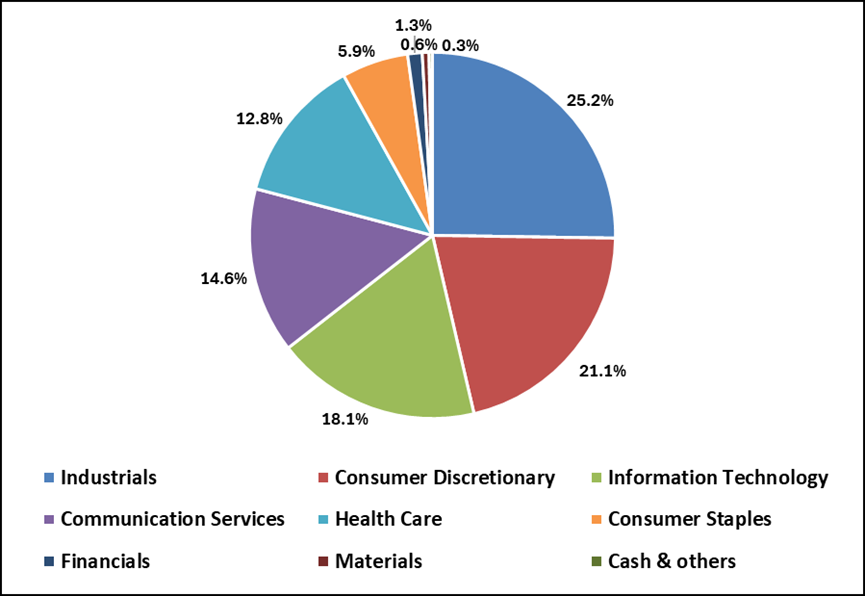

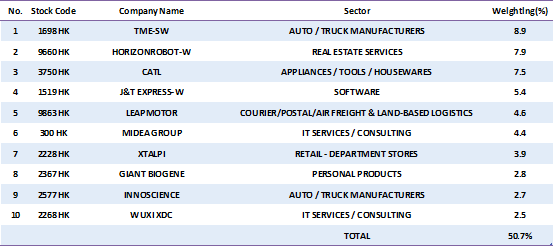

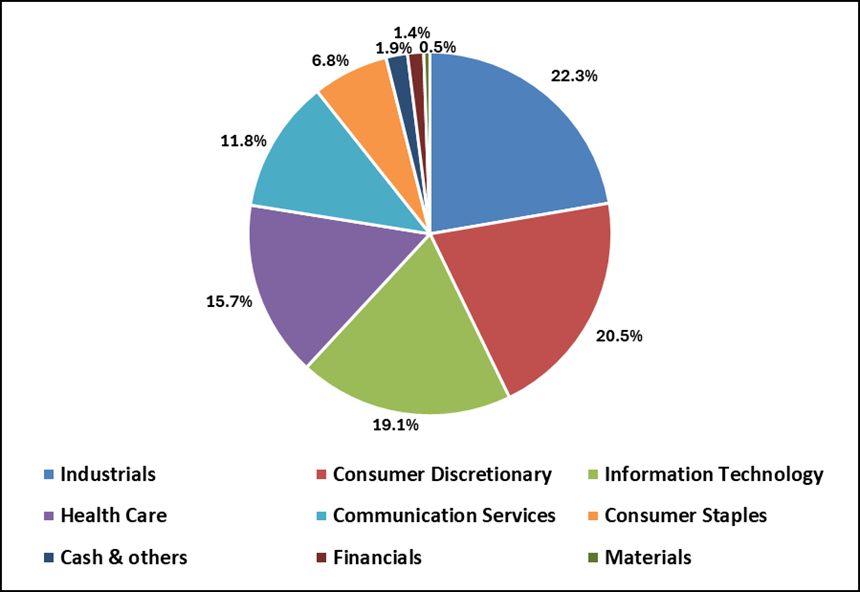

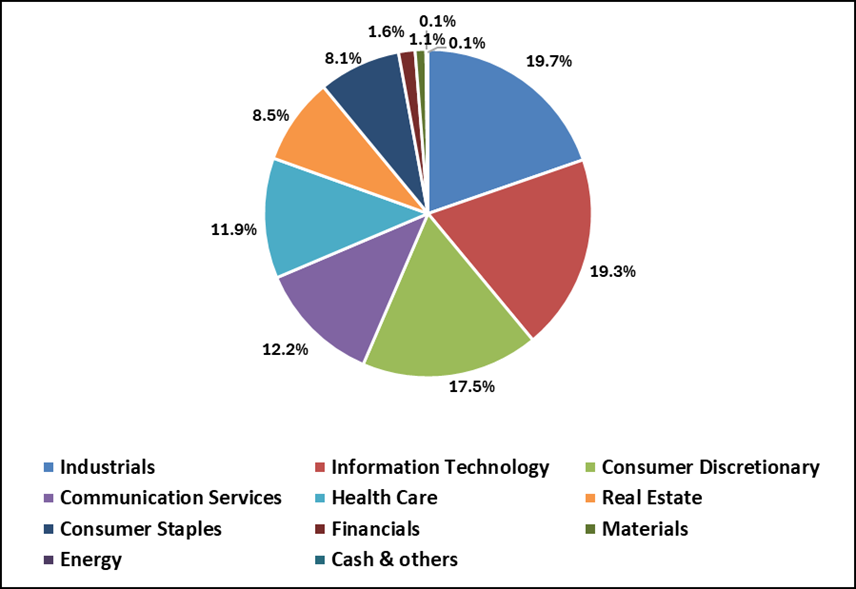

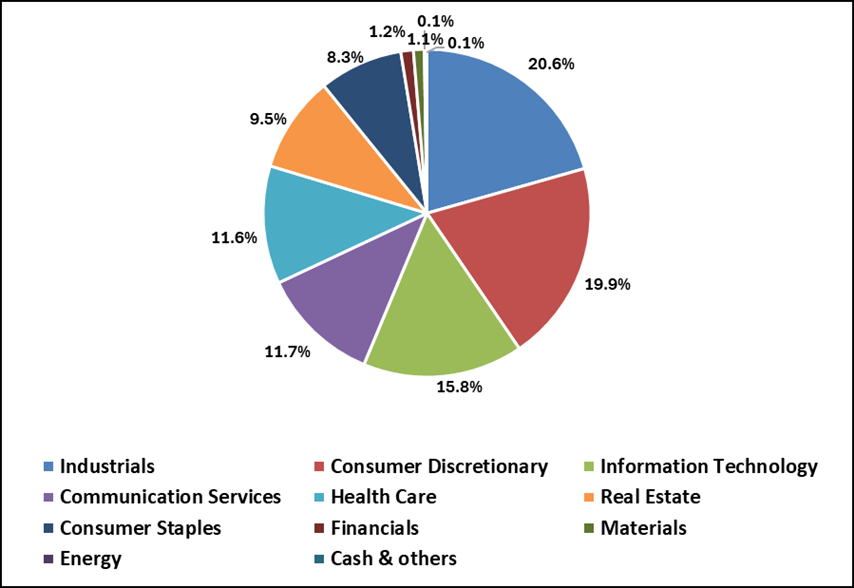

This month, the Phillip Hong Kong Newly Listed Equities Index ETF’s top ten holdings changed. TME-SW (1698.HK), LEAPMOTOR (9863.HK), and CHERY AUTO (9973.HK) fell out of the top ten holdings due to quarterly rebalancing mechanism, while PONY-W (2026.HK), INNOSCIENCE (2577.HK), and WUXI XDC (2268.HK) became the new top ten holdings. The following industries are currently the focus of the index: industrials (including CATL, J&T EXPRESS-W, and UBTECH ROBOTICS), information technology (including HORIZON ROBOT, PONY-W, and INNOSCIENCE), and consumer discretionary (including MIDEA, LAOPU GOLD, and HESAI-W). The following figures show the top 10 holdings and sector breakdown of the Phillip HK Newly Listed Equities Index:

Key Components Update

- HORIZON ROBOT-W (9660.HK): Horizon Robot reports that its subsidiary Digua Robotics has launched over 100 products, including the Narwal robot vacuum cleaner, the Vita Power robot dog, and the Insta360 panoramic drone. The company collaborates with more than 100 partners and supports over 100,000 developers. It also introduced a one‑stop development platform combining a data closed loop, an embodied‑intelligence training ground, and an agent service, enabling faster algorithm development and reducing the product cycle to as little as one year.

- CATL (3750.HK): On December 28th, CATL announced that by 2026, it will widely apply sodium batteries in battery swapping, passenger vehicles, commercial vehicles, and energy storage, potentially creating a new trend of “sodium and lithium batteries shining brightly together.” The company’s products are positioned as automotive-grade start-stop batteries and power batteries, featuring high-performance targets such as an energy density of 175 Wh/kg and the ability to retain 90% of capacity even at extremely low temperatures of –40°C. Furthermore, CATL’s new sodium-ion battery has passed certification, becoming the world’s first sodium-ion battery to pass the new national standard certification.

- J&T EXPRESS-W (1519.HK): On December 25, J&T Express signed two share transfer agreements. Its subsidiary Onwing Global will acquire 36.99% of Jet Global for up to US$950 million, while another subsidiary, J&T KSA, plans to acquire 46.55% of JNT Express KSA for up to US$106 million. Before the conversion of convertible notes held by New Exploration Investment, J&T Express indirectly holds 63.81% of Jet Global and 53.45% of JNT Express KSA.

- MIDEA GROUP (300.HK): On December 18, Midea Group announced the establishment of a New Energy Business Division, with the Group’s Executive President, Wang Jianguo, personally serving as the division’s president. The new division will report directly to the group’s headquarters. This organizational upgrade marks the official elevation of the new energy business into a core strategic pillar, fully launching a three‑pronged growth model of “home appliances + new energy + healthcare”. This structural adjustment not only provides organizational support for the scaled development of the new energy business but also builds a key bridge for technological synergies and resource sharing between the healthcare and new energy sectors, laying a solid foundation for deeper integration of the group’s two major strategic tracks.

- PONY-W (2026.HK): Pony announced that its Robotaxi fleet has reached 1,159 vehicles, exceeding its original annual strategic target of 1,000 vehicles. This milestone was achieved thanks to its rapid business expansion since the third quarter. Pony’s financial performance provides a solid foundation for this expansion; the company’s total revenue in the third quarter of 2025 was RMB 181 million, a year-on-year increase of 72%, marking three consecutive quarters of revenue growth. Its robotaxi business revenue reached RMB 47.7 million, an increase of 89.5% year-on-year, of which passenger fare revenue surged by more than 200% year-on-year.

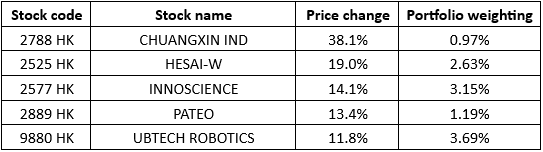

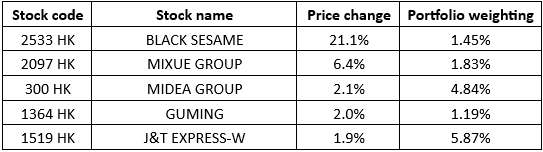

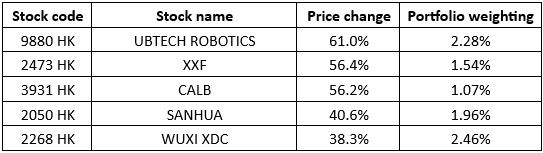

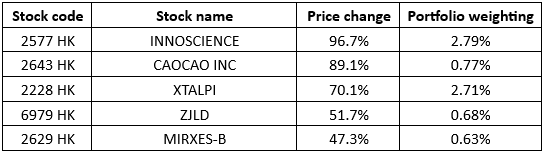

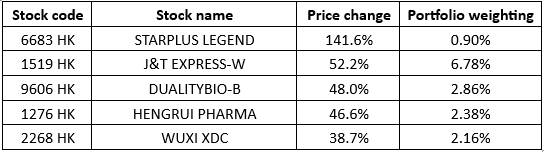

Top constituent movers in December:

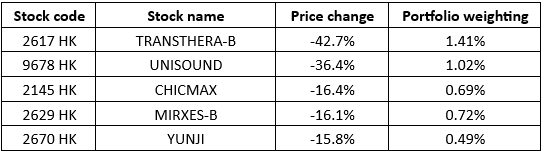

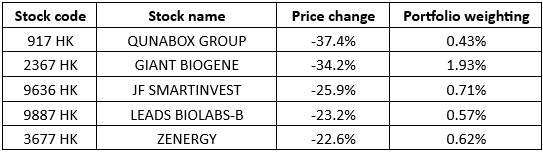

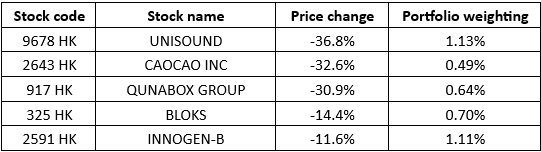

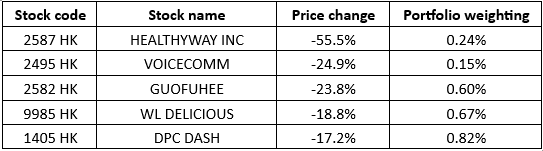

Bottom constituent movers in December:

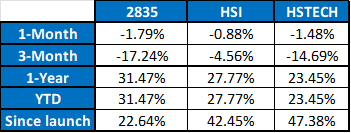

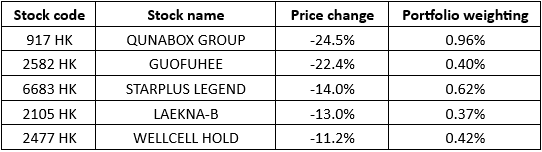

The Phillip HK Newly Listed Index ETF (2835.HK) monthly performance for December

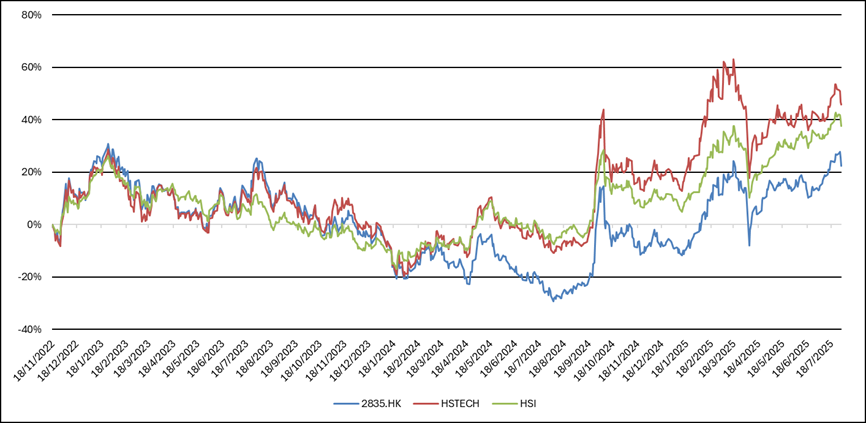

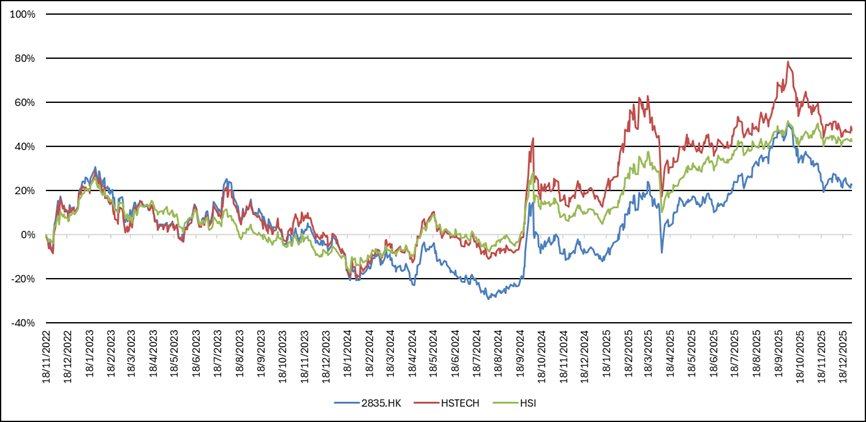

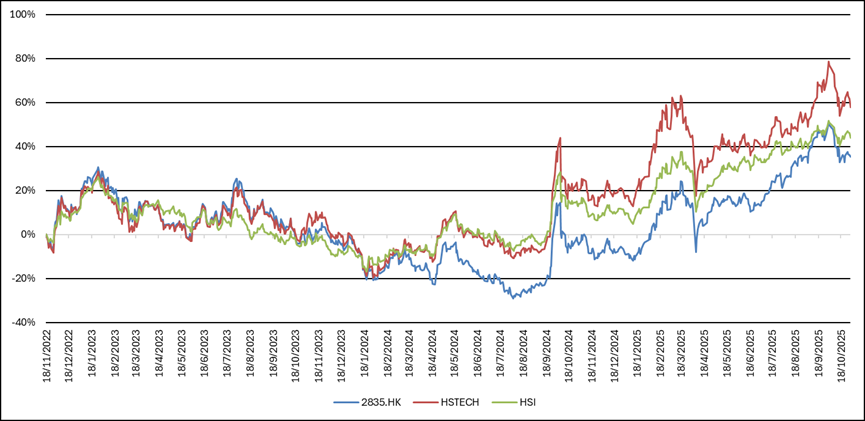

The Phillip HK Newly Listed Index ETF (2835.HK) recorded a 1.79% monthly decrease in December, underperforming the Hang Seng Index’s (HSI) 0.88% monthly decrease and the Hang Seng Tech Index’s (HSTI) 1.48% monthly decrease. As of December 31st, this ETF had grown 22.64% since its listing, underperforming the HSI’s rose of 42.45% and the HSTI’s rose of 47.38%.

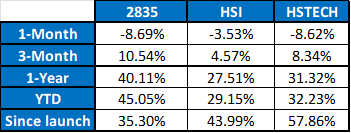

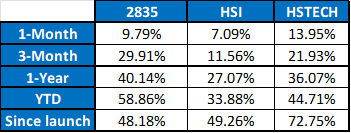

The following table compares the performance of the Phillip Hong Kong IPO Index ETF (2835.HK), the Hang Seng Index (HSI), and the Hang Seng Tech Index (HSTECH):

The IPO market performance in November

There were twelve new stocks listed on HKEX in November, which is the same as the number of listings in October. As of November 30th, the overall performance of the IPO market was divided. Among them, VIGONVITA-B (2630.HK) and QUANTGROUP (2685.HK) saw a 110% and 77% increase in share price, respectively, since listing. Whereas JOYSON ELEC (699.HK) and WERIDE-W (800.HK) saw a 25% and 23% decrease in share price since listing, respectively.

Phillip Hong Kong Newly Listed Equities Index ETF (2835.HK)

The ETF aims to fully replicate the Solactive Hong Kong Newly Listed Equities Index, a rules-based equity benchmark designed to track the performance of securities that had a recent initial public offering or new listing on the main board of HKEX. The index is rebalanced quarterly, incorporating securities with IPOs or new listings within the last 756 business days, aiming for a total of 50 securities based on free-float market capitalization. The index also undergoes monthly IPO reviews to include recent IPOs, subject to liquidity and market capitalisation criteria.

November Monthly Review

Solactive HK Newly Listed Equities Index included CHERY AUTO (9973.HK), SANY HEAVY IND (6031.HK), PATEO (2889.HK), and 160 HEALTH (2656.HK) in November through the fast-track mechanism. And it also removed BEAUTYFARM MED (2373.HK). The current number of constituent stocks has increased from 51 to 54.

HESAI-W (2525.HK) is a passenger vehicle company that designs, develops, manufactures, and sells a diverse and expanding portfolio of passenger vehicles, including internal combustion engine (ICE) vehicles and new energy vehicles (NEVs), to cater to the distinct and evolving needs and preferences of customers in both the domestic and overseas markets. The company has five major brands: CHERY, JETOUR, EXEED, iCAR and LUXEED. As the signature brand, CHERY is positioned as a first-rated car brand of safety, comfort and quality for the mass market and family use; JETOUR targets customers who are passionate about family travel and outdoor leisure; EXEED targets customers who value performance and elegance; iCAR targets Generation Z customers who are keen on technology and value freedom; and LUXEED targets customers who pursue intelligence, performance, and innovation. According to data, the company is the second largest Chinese domestic brand passenger vehicle company and the 11th largest passenger vehicle company globally in terms of global sales volume of passenger vehicles in 2024.

As of December 31st, 2024, the company’s revenue in 2024 was 269.90 billion yuan (RMB, the same below), a year-on-year increase of 65.4%. Gross profit was 10.22 billion yuan, an increase of 39.2% YoY; the gross profit margin decreased from 16.0% in 2023 to 13.5% in 2024. The net profit attributable to the company’s equity holders in 2024 was 14.33 billion yuan, an increase of 37.2% YoY. The company’s gross profit increased, but the gross profit margin decreased, mainly due to changes in the product mix and the reduction in gross profit margin caused by overseas taxes on imported cars.

Top 10 Holdings

This month, the Phillip Hong Kong Newly Listed Equities Index ETF’s top ten holdings changed. BOSS ZHIPIN-W (2076.HK) and WUXI XDC (2268.HK) fell out of the top ten holdings due to price movement, while CHERY AUTO (9973.HK) and LAOPU GOLD (6181.HK) became the new top ten holdings. The following industries are currently the focus of the index: consumer discretionary (including MIDEA, LEAPMOTOR, and CHERY AUTO), industrials (including CATL, J&T EXPRESS-W, and UBTECH ROBOTICS), and information technology (including HORIZON ROBOT, INNOSCIENCE, and KINGSOFT CLOUD). The following figures show the top 10 holdings and sector breakdown of the Phillip HK Newly Listed Equities Index:

Key Components Update

- TME-SW (1698.HK): Tencent Music released its Q3 2025 report. The report shows that the company’s total quarterly revenue was 8.46 billion yuan (RMB, the same below), a year-on-year increase of 20.6%, and adjusted net profit was 2.48 billion yuan, a year-on-year increase of 27.7%. Among them, the online music business achieved excellent performance across the board, continuing to drive Tencent Music’s high-quality growth. Online music service revenue in Q3 increased by 27.2% year-on-year to 6.97 billion yuan, and the average monthly revenue per paying user increased from 10.8 yuan in the same period of 2024 to 11.9 yuan.

- HORIZON ROBOT-W (9660.HK): At the Horizon Robotics HSD mass production media communication conference held on November 22nd, Horizon Robotics officially announced that its urban assisted driving system HSD has officially entered a new stage of mass production. Currently, it has obtained designated cooperation from as many as 10 domestic and foreign car brands, covering more than 20 car models. Currently, Horizon Robotics’ Journey family of vehicles has surpassed 10 million units in mass production and shipments, making it the first intelligent driving technology company in China to achieve this milestone. With the large-scale production of the first batch of HSD (Hardware-Defined Sight) vehicles, Horizon Robotics has also become the first intelligent driving technology company in the industry to achieve mass production of low, medium, and high-level assisted driving systems.

- CATL (3750.HK): CATL’s battery factory in Spain is expected to begin production by the end of next year, supplying batteries to Stellantis’ automotive factory. CATL stated that it will train up to 4,000 workers to operate this, the largest battery factory in Spain. This investment of €4.1 billion represents the largest Chinese foreign investment in Spain, and the project has also received €300 million in funding from the European Union.

- J&T EXPRESS-W (1519.HK): According to J&T’s official sales report, driven by global e-commerce promotions such as Singles’ Day and Black Friday, J&T’s global parcel volume exceeded 100 million pieces again on November 11th, setting a new record, representing a year-on-year increase of 9%. From November 1st to November 12th, J&T’s average daily parcel volume in the global market reached 94.59 million pieces, a year-on-year increase of 15%, with Southeast Asia growing by 78% and new markets by 83%, demonstrating strong overseas growth.

- MIDEA GROUP (300.HK): On November 21st, Midea Group and BYD officially signed a strategic cooperation agreement on “Smart Ecosystem for People, Vehicles, and Homes” at BYD’s global headquarters in Shenzhen. The two parties will conduct in-depth cooperation in multiple dimensions, including joint technology research and development, standards setting, ecosystem interconnection, and channel marketing. BYD Group’s entire brand of vehicles will engage in comprehensive cooperation with Midea Group’s Midea, COLMO, Little Swan, Hualing, Toshiba and other brands, gradually integrating a full range of products such as smart home appliances, smart home devices and IoT vehicle products to build a fully seamless interconnected system.

Top constituent movers in November:

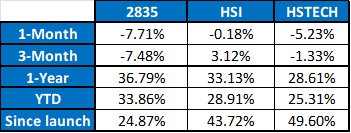

Bottom constituent movers in November:

The Phillip HK Newly Listed Index ETF (2835.HK) monthly performance for November

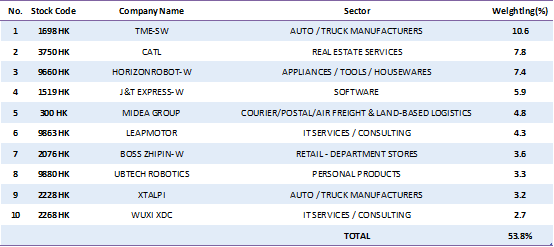

The Phillip HK Newly Listed Index ETF (2835.HK) recorded a 7.71% monthly decrease in November, underperforming the Hang Seng Index’s (HSI) 0.18% monthly decrease and the Hang Seng Tech Index’s (HSTI) 5.23% monthly decrease. As of November 30th, this ETF had grown 24.87% since its listing, underperforming the HSI’s rose of 43.72% and the HSTI’s rose of 49.60%.

The following table compares the performance of the Phillip Hong Kong IPO Index ETF (2835.HK), the Hang Seng Index (HSI), and the Hang Seng Tech Index (HSTECH):

The IPO market generally performed well in October

There were twelve new stocks listed on HKEX in October, which continued to increase in comparison to the ten initial public offerings (IPOs) in September. As of October 31st, despite FIBOCOM (638.HK) saw a 9% decrease in share price since listing, other IPOs all saw rise in share prices. Among them, XUANZHUBIO-B (2575.HK) and DEEPEXI TECH (1384.HK) saw a 448% and 327% increase in share price, respectively, since listing.

Phillip Hong Kong Newly Listed Equities Index ETF (2835.HK)

The ETF aims to fully replicate the Solactive Hong Kong Newly Listed Equities Index, a rules-based equity benchmark designed to track the performance of securities that had a recent initial public offering or new listing on the main board of HKEX. The index is rebalanced quarterly, incorporating securities with IPOs or new listings within the last 756 business days, aiming for a total of 50 securities based on free-float market capitalization. The index also undergoes monthly IPO reviews to include recent IPOs, subject to liquidity and market capitalisation criteria.

October Monthly Review

Solactive HK Newly Listed Equities Index included HESAI-W (2525.HK) in October through the fast-track mechanism. The current number of constituent stocks has increased from 50 to 51.

HESAI-W (2525.HK) is a global leader in three-dimensional light detection and ranging (LiDAR) solutions. The company design, develop, manufacture, and sell advanced LiDAR products. According to the data, it was the No. 1 LiDAR supplier globally in each of 2022, 2023 and 2024 in terms of revenue. And it achieved the highest gross margin and gross profit among LiDAR companies worldwide in 2022, 2023, and 2024. By December 2024, the company became the first LiDAR company globally to achieve 100,000 units shipment in a single month.

As of December 31st, 2024, the company’s revenue in 2024 was 20.77 billion yuan (RMB, the same below), a year-on-year increase of 10.7%. Gross profit was 8.85 billion, an increase of 33.7% YoY; the gross profit margin rose from 35.2% in 2023 to 42.6% in 2024. The net loss attributable to the company’s equity holders in 2024 was narrowed significantly to 1.02 billion, a decrease of 364.8% YoY. The increase in the company’s gross profit margin is primarily attributable to effective cost optimization due to product iteration and economies of scale for both ADAS and Robotics LiDAR products.

Top 10 Holdings

This month, the Phillip Hong Kong Newly Listed Equities Index ETF’s top ten holdings changed. GIANT BIOGENE (2367.HK) and INNOSCIENCE (2577.HK) fell out of the top ten holdings due to price movement, while BOSS ZHIPIN-W (2076.HK) and UBTECH ROBOTICS (9880.HK) became the new top ten holdings. The following industries are currently the focus of the index: industrials (including CATL, J&T EXPRESS-W, and UBTECH ROBOTICS), consumer discretionary (including MIDEA, LEAPMOTOR, and LAOPU GOLD), and information technology (including HORIZON ROBOT, INNOSCIENCE, and KINGSOFT CLOUD). The following figures show the top 10 holdings and sector breakdown of the Phillip HK Newly Listed Equities Index:

Key Components Update

- TME-SW (1698.HK): On October 9th, Billboard, a renowned international music brand, partnered with Tencent Music’s QQ Music and JOOX platforms to launch the “Star Power” monthly selection event. This selection will fully integrate Billboard’s authoritative influence in the global music market with Tencent Music’s content ecosystem advantages in the Chinese music market. By establishing a professional and systematic monthly selection mechanism, it will focus on the global dissemination of high-quality Chinese music content, further promoting Chinese music to the world and continuously enhancing its competitiveness and influence in the global music market.

- CATL (3750.HK): On October 20th, CATL released its 2025 Q3 report. The report shows that the company achieved revenue of 283.07 billion (RMB, the same below) in 2025 Q1-Q3, an increase of 9.28% YOY, and net profit attributable to equity holders of the company of 49.03 billion, an increase of 36.2% YOY. In 2025 Q3, the company achieved revenue of 104.19 billion, a year-on-year increase of 12.9% and a quarter-on-quarter increase of 10.6%. Net profit attributable to equity holders was 18.55 billion, a year-on-year increase of 41.2% and a quarter-on-quarter increase of 12.3%.

- HORIZON ROBOT-W (9660.HK): Horizon Robot has successfully secured orders for mainstream vehicle platforms from Japan’s top OEMs, marking a further breakthrough for China’s intelligent driving solutions in the international mainstream supply chain. Going forward, the company will provide them with mid-to-high-end assisted driving solutions based on the Journey 6 series chips. It is understood that the vehicle platform involved in this collaboration covers the main models sold by this top Japanese OEM in the Chinese market, which constitute the majority of its sales volume in China.

- J&T EXPRESS-W (1519.HK): J&T Express announced its key operating data for 2025 Q3. As of September 30th, 2025, the company achieved approximately 7.68 billion parcels, representing a year-on-year increase of 23.1%. Among that, Southeast Asia parcels reached 2 billion, a year-on-year increase of 78.7%; China parcels reached 5.58 billion, a year-on-year increase of 10.4%; and new markets parcels reached 100 million, a year-on-year increase of 47.9%. In the first three quarters, the Group’s total parcel volume reached 21.67 billion, a year-on-year increase of 25.6%.

- MIDEA GROUP (300.HK): Midea Group announced its 2025 Q3 report. As of September 30, 2025, the company’s operating revenue was 363.06 billion (RMB, the same below), a year-on-year increase of 13.82%; net profit attributable to equity holders of the company was 37.88 billion, a year-on-year increase of 19.51%. In the third quarter, the company’s operating revenue was 111.93 billion, an increase of 10.06% year-on-year; the net profit attributable to equity holders of the company was 11.87 billion, an increase of 8.95% year-on-year.

Top constituent movers in October:

Bottom constituent movers in October:

The Phillip HK Newly Listed Index ETF (2835.HK) monthly performance for October

The Phillip HK Newly Listed Index ETF (2835.HK) recorded an 8.69% monthly decrease in October, underperforming the Hang Seng Index’s (HSI) 3.53% monthly decrease and the Hang Seng Tech Index’s (HSTI) 8.62% monthly decrease. As of October 31st, this ETF had grown 35.30% since its listing, underperforming the HSI’s rose of 43.99% and the HSTI’s rose of 57.86%.

The following table compares the performance of the Phillip Hong Kong IPO Index ETF (2835.HK), the Hang Seng Index (HSI), and the Hang Seng Tech Index (HSTECH):

The IPO market generally performed well in September

The total number of new listings in September increased in comparison to the six initial public offerings (IPOs) in August, as there were ten new stocks listed on HKEX. As of September 30th, despite AUX ELECTRIC (2580.HK) seeing an 18% decrease in share price since listing, other IPOs all saw a rise in share prices. Among them, HIPINE (2583.HK) and 160 HEALTH (2656.HK) saw a 258% and 154% increase in share price, respectively, since listing.

Phillip Hong Kong Newly Listed Equities Index ETF (2835.HK)

The ETF aims to fully replicate the Solactive Hong Kong Newly Listed Equities Index, a rules-based equity benchmark designed to track the performance of securities that had a recent initial public offering or new listing on the main board of HKEX. The index is rebalanced quarterly, incorporating securities with IPOs or new listings within the last 756 business days, aiming for a total of 50 securities based on free-float market capitalization. The index also undergoes monthly IPO reviews to include recent IPOs, subject to liquidity and market capitalisation criteria.

September Monthly Review

Solactive HK Newly Listed Equities Index included BOSS ZHIPIN-W (2076.HK), SKB BIO-B (6990.HK), LAOPU GOLD (6181.HK), UNISOUND (9678.HK), INNOGEN-B (2591.HK), SF HOLDING (6936.HK), REPT BATTERO (666.HK), ZENERGY (3677.HK), SUNSHINE INS (6963.HK), and SUNSHINE PHARMA (6887.HK) in September through the quarterly rebalancing mechanism. And it also removed BEKE-W (2423.HK), MNSO (9896.HK), TRANSTHERA-B (2617.HK), MIRXES-B (2629.HK), STARPLUS LEGEND (6683.HK), TIANQI LITHIUM (9696.HK), SYNAGISTICS (2562.HK), CR BEVERAGE (2460.HK), TS LINES (2510.HK), WELLCELL HOLD (2477.HK), GUOFUHEE (2582.HK), LAEKNA-B (2105.HK), MICROPORT NEURO (2172.HK), RIMAG GROUP (2522.HK), TANWAN (9890.HK), YSB (9885.HK), HEALTHYWAY INC (2587.HK), GREEN TEA GROUP (6831.HK), VOICECOMM (2495.HK), DRINDA (2865.HK), and ETERNAL BEAUTY (6883.HK). The current number of constituent stocks has decreased from 61 to 50.

BOSS ZHIPIN-W (2076.HK) was first introduced and listed on HKEX in 2022, then it issued new shares for subscription in June 2025 and was therefore re-included in the Newly Listed Equities Index. The company pioneered the “direct recruitment model”, leveraging a mobile-native platform to innovatively integrate two-way communication and referrals into the online recruitment process, recreating the essence of a real-world recruitment scenario. The company was the first to adopt this model in China’s online recruitment industry. The development of this innovative business model, fundamentally different from existing models from the outset, has since transformed China’s online recruitment industry and user behaviour.

As of June 30th, 2025, the company’s half-year revenue in 2025 was 4.03 billion yuan (RMB, the same below), a year-on-year increase of 11.2%. Gross profit was 1.09 billion, an increase of 136.0% YoY; the gross profit margin rose from 12.8% in 2024 to 27.1% in 2025 for the same period. The increase in the company’s revenue and gross profit was mainly driven by the growth of paying enterprise customers and the reduction of expenses such as operating costs and marketing expenses.

Top 10 Holdings

This month, the Phillip Hong Kong Newly Listed Equities Index ETF’s top ten holdings changed. BEKE-W (2423.HK) fell out of the top ten holdings due to listing for over 3 years, while WUXI XDC (2268.HK) became the new top ten holding. The following industries are currently the focus of the index: industrials (including CATL, J&T EXPRESS-W, and UBTECH ROBOTICS), consumer discretionary (including LEAPMOTOR, MIDEA, and LAOPU GOLD), and information technology (including HORIZON ROBOT, INNOSCIENCE, and KINGSOFT CLOUD). The following figures show the top 10 holdings and sector breakdown of the Phillip HK Newly Listed Equities Index:

Key Components Update

- TME-SW (1698.HK): According to data, the Chinese online music market has limited room for new user growth, presenting a stable oligopoly structure. The competitive landscape is better than overseas. The total user base of Tencent Music, NetEase Cloud Music, and Soda Music is approximately 7:3:1, while the paid user ratio is approximately 20:7:1. TME, with its comprehensive music library, tiered membership system, and diversified content ecosystem, combined with community interaction and long-form audio content, maintains its leading position in the Chinese market. After acquiring Himalaya, TME will complete its transformation from a “music platform” to a “full-scenario audio ecosystem platform”, building a diversified growth path driven by subscriptions, advertising, fan economy, and long-form audio content.

- HORIZON ROBOT-W (9660.HK): On September 26th, Horizon Robot announced a financing plan to raise approximately HK$5.8 billion. In explaining the use of the funds, the company explicitly mentioned investing in new areas, such as Robotaxi-related projects. In addition to investing in the new field of Robotaxi, this funding will also be used to expand overseas business (previous financing was mainly used for domestic expansion); invest in R&D to improve technology, especially mid-to-high-end assisted driving solutions; and make strategic investments in upstream and downstream partners.

- CATL (3750.HK): On September 29th, CATL’s wholly-owned subsidiary, Hainan CATL Electric Service Technology Co., Ltd., officially signed a strategic cooperation agreement with the Longhua District People’s Government of Haikou City, announcing its plan to invest in and build 100 battery swapping stations throughout Hainan Province by 2030. This move marks a key step in CATL’s battery swapping network layout in South China, injecting strong momentum into the construction of Hainan Free Trade Port’s green transportation system. At the same time, Chocolate Battery Swapping will establish its Hainan regional headquarters in Longhua District to comprehensively coordinate the investment, construction, operation, and settlement of battery swapping stations throughout the province, building a highly efficient service system based on local languages.

- J&T EXPRESS-W (1519.HK): Recently, the Shanghai branches of five companies—YTO Express, STO Express, ZTO Express, Yunda Express, and J&T Express—issued a notice to customers stating: “In order to implement the national policy on ‘anti-involution’ competition in various industries, eliminate improper behaviour that disrupts market order through low prices, continuously provide stable services to customers, and return to healthy development, it has been decided that, starting from 00:00 on September 22, 2025, the express delivery price for all users in the Shanghai area will be increased. Users are requested to promptly enquire with their local branches for price confirmation.”

- LEAPMOTOR (9863.HK): Leapmotor announced its latest delivery data for September, with a record-breaking 66,657 units delivered, exceeding 60,000 units for the first time. This September delivery volume follows a continuous increase in deliveries from March to August this year. Since 2025, Leapmotor has led the new energy vehicle brands for seven consecutive months. The company achieved its first-ever net profit in the first half of 2025, becoming the second Chinese electric vehicle startup to achieve profitability in the first half of the year.

Top constituent movers in September:

Bottom constituent movers in September:

The Phillip HK Newly Listed Index ETF (2835.HK) monthly performance for September

The Phillip HK Newly Listed Index ETF (2835.HK) recorded a 9.79% monthly increase in September, overperforming the Hang Seng Index’s (HSI) 7.09% monthly increase but underperforming the Hang Seng Tech Index’s (HSTI) 13.95% monthly increase. As of September 30th, this ETF had grown 48.18% since its listing, underperforming the HSI’s rose of 49.26% and the HSTI’s rose of 72.75%.

The following table compares the performance of the Phillip Hong Kong IPO Index ETF (2835.HK), the Hang Seng Index (HSI), and the Hang Seng Tech Index (HSTECH):

The IPO market generally performed well in August

The total number of listings in August continued to reduce in comparison to the ten initial public offerings (IPOs) in July, as there were six new stocks listed on HKEX. As of August 31st, despite SUNSHINE PHARMA (6887.HK) saw a 10% decrease in share price since listing, other IPOs all saw rise in share prices. Among them, AB&B BIO-TECH-B (2627.HK) and JIAXIN INTL RES (3858.HK) saw a 295% and 175% increase in share price, respectively, since listing.

Phillip Hong Kong Newly Listed Equities Index ETF (2835.HK)

The ETF aims to fully replicate the Solactive Hong Kong Newly Listed Equities Index, a rules-based equity benchmark designed to track the performance of securities that had a recent initial public offering or new listing on the main board of HKEX. The index is rebalanced quarterly, incorporating securities with IPOs or new listings within the last 756 business days, aiming for a total of 50 securities based on free-float market capitalization. The index also undergoes monthly IPO reviews to include recent IPOs, subject to liquidity and market capitalisation criteria.

August Monthly Review

Solactive HK Newly listed Equities Index included GEEKPLUS-W (2590.HK), HAITIAN FLAV (3288.HK), LEADS BIOLABS-B (9887.HK), and LENS (6613.HK) in August through the fast-track mechanism. The current number of constituent stocks has increased from 57 to 61.

GEEKPLUS-W (2590.HK) is a leader in the global autonomous mobile robot (“AMR”) market. The company offers a series of AMR solutions to empower warehouse fulfilment and industrial material transport, enhancing supply chain efficiency while reducing reliance on manual labour. According to data, as of December 31st, 2024, the company has shipped approximately 56,000 AMRs across over 40 countries and regions worldwide. In 2024, it occupied a 9.0% market share in the overall global warehouse fulfilment AMR solution market and approximately 1% market share of the global warehouse automation solution market.

As of December 31st, 2024, the company’s revenue in 2024 was 2.41 billion yuan (RMB, the same below), a year-on-year increase of 12.4%. Gross profit was 837.17 million, an increase of 27.0% YoY; the gross profit margin rose from 30.8% in 2023 to 34.8% in 2024. The company’s revenue growth stems from an increase in the number of customers and an increase in average revenue per customer, which led to increased sales of the company’s warehouse fulfilment AMR solutions. Furthermore, the company’s gross margin in 2024 also increased due to a steady decline in costs, driven by continued cost reductions through product design optimization and supply chain sourcing.

Top 10 Holdings

This month, the Solactive Hong Kong Newly Listed Equities Index’s top ten holdings changed. DUALITYBIO-B (9606.HK) and MIXUE GROUP (2097.HK) fell out of the top ten holdings due to price fluctuations, while INNOSCIENCE (2577.HK) and XTALPI (2228.HK) became the new top ten holdings. The following industries are currently the focus of the index: industrials (including J&T EXPRESS-W, CATL, and TUHU-W), information technology (including HORIZON ROBOT, INNOSCIENCE, and KINGSOFT CLOUD), and consumer discretionary (including MIDEA, LEAPMOTOR, and MIXUE GROUP). The following figures show the top 10 holdings and sector breakdown of the Phillip HK Newly Listed Equities Index:

Key Components Update

- TME-SW (1698.HK): Tencent Music recently announced its unaudited financial results for the second quarter ended June 30th, 2025. In the second quarter of 2025, the company’s total revenue was 8.44 billion (RMB, the same below), increase of 17.9% YoY, primarily driven by strong year-on-year growth in online music service revenue and partially offset by a decline in social entertainment and other services. Gross profit margin increased to 44.4% from 42.0% in the same period of 2024, primarily due to strong growth in music subscription revenue and advertising service revenue, and a decrease in the revenue share from social entertainment services. Net profit attributable to equity holders was 2.41 billion, a year-on-year increase of 43.2%.

- BEKE-W (2423.HK): Beke recently announced its unaudited financial results for the six months ended June 30th, 2025. The company’s total transaction volume was 1,722.4 billion (RMB, the same below), a 17.3% increase from the same period of 2024. Gross profit was 10.5 billion, relatively flat compared to the same period in 2024. Gross profit margin was 21.3%, compared to 26.8% in the same period in 2024. The decline in gross profit margin was primarily due to a decrease in the proportion of net revenue contributed by the existing housing business, which has higher profit margins, and an increase in the proportion of fixed compensation costs in the net revenue of the existing housing business, resulting in a lower contribution margin from the existing housing business. Net profit attributable to equity holders of the company was 2.32 billion, a year-on-year increase of 7.7%.

- HORIZON ROBOT-W (9660.HK): Horizon Robotics recently announced its unaudited financial results for the six months ended June 30th, 2025. Revenue increased by 67.6% year-on-year to 1.57 billion (RMB, the same below). Gross profit was 1.02 billion, a year-on-year increase of 38.6%. Gross profit margin decreased from 79.0% to 65.4%. The fluctuation was primarily due to changes in revenue mix, particularly the significant increase in the proportion of automotive product solutions revenue, and the company’s rapidly growing delivery volume. Although the gross profit margin of automotive product solutions revenue was higher than the same period last year, the smaller proportion of revenue from the higher-margin licensing and service business led to a decline in the blended gross profit margin.

- J&T EXPRESS-W (1519.HK): J&T Express recently announced its unaudited consolidated interim results for the six months ended June 30th, 2025. The company’s revenue increased by 13.1% year-on-year to 5.50 billion (RMB, the same below), primarily from express delivery services. Gross profit was 540 million, a year-on-year increase of 12.7%. The gross profit margin decreased from 11.0% in the first half of 2024 to 9.8% in the first half of 2025. Net comprehensive profit attributable to equity holders was 86 million, a year-on-year increase of 213.0%.

- CATL (3750.HK): On August 28th, CATL and the Changzhou Municipal People’s Government signed a strategic cooperation framework agreement to build a zero-carbon ecological city across the region. The two companies will jointly explore new paths for urban zero-carbon development and promote the promotion and application of new energy in various urban scenarios. The two sides will also further expand the “generation, storage, transmission, use, and network” industry ecosystem, jointly cultivate microgrid projects, accelerate the formation of a microgrid industry cluster with a scale of hundreds of billions of yuan, and build Changzhou into a green and low carbon microgrid demonstration city.

Top constituent movers in August:

Bottom constituent movers in August:

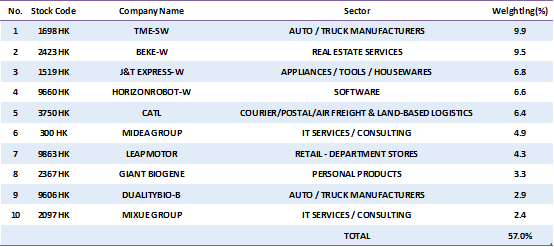

The Phillip HK Newly Listed Index ETF (2835.HK) monthly performance for August

The Phillip HK Newly Listed Index ETF (2835.HK) recorded a 10.26% monthly increase in August, overperforming the Hang Seng Index’s (HSI) 1.23% monthly increase and the Hang Seng Tech Index’s (HSTI) 4.06% monthly increase. As of August 31st, this ETF had grown 34.96% since its listing, underperforming the HSI’s rose of 39.38% and the HSTI’s rose of 51.61%.

The following table compares the performance of the Phillip Hong Kong IPO Index ETF (2835.HK), the Hang Seng Index (HSI), and the Hang Seng Tech Index (HSTECH):

The IPO market showed a trend of differentiation in July

The total number of listings in July slightly reduced in comparison to the fifteen initial public offerings (IPOs) in June, but there were still ten new stocks listed on HKEX, and the overall performance of the IPO market was divided. As of July 31st, LEADS BIOLABS-B (9887.HK) and FORTIOR (1304.HK) saw a 106% and 26% increase in share price, respectively, since listing. Whereas CLOUDBREAK-B (2592.HK) and DAZHONG DENTAL (2651.HK) saw a 47% and 28% decrease in share price since listing, respectively.

Phillip Hong Kong Newly Listed Equities Index ETF (2835.HK)

The ETF aims to fully replicate the Solactive Hong Kong Newly Listed Equities Index, a rules-based equity benchmark designed to track the performance of securities that had a recent initial public offering or new listing on the main board of HKEX. The index is rebalanced quarterly, incorporating securities with IPOs or new listings within the last 756 business days, aiming for a total of 50 securities based on free-float market capitalization. The index also undergoes monthly IPO reviews to include recent IPOs, subject to liquidity and market capitalisation criteria.

July Monthly Review

Solactive HK newly listed Equities Index included HENGRUI PHARMA (1276.HK), SANHUA (2050.HK), TRANSTHERA-B (2617.HK), MIRXES-B (2629.HK), CAOCAO INC (2643.HK), ETERNAL BEAUTY (6883.HK), GREEN TEA GROUP (6831.HK), and DRINDA (2865.HK) in July through the fast-track mechanism. And it also removed ZENERGY (3677.HK). The current number of constituent stocks has increased from 50 to 57.

HENGRUI PHARMA (1276.HK) is a leading innovative global pharmaceutical company rooted in China. The company strategically focus on comprehensive therapeutic areas with significant unmet medical needs and growth potential. These mainly include oncology, metabolic and cardiovascular diseases, immunological and respiratory diseases, and neuroscience. According to data, the aggregate global pharmaceutical market corresponding to the company’s major therapeutic areas in 2023 was US$845.8 billion, accounting for 57.4% of the overall global pharmaceutical market for the same year; and it is expected to grow at a CAGR of 6.4% from 2023 to 2028, surpassing the CAGR of 5.7% for the overall global pharmaceutical market growth during the same period.

As of December 31st, 2024, the company’s revenue in 2024 was 279.85 billion yuan (RMB, the same below), a year-on-year decrease of 22.6%. Gross profit was 241.36 billion, an increase of 25.1% YoY; the gross profit margin rose from 84.6% in 2023 to 86.2% in 2024. The profit for the year attributable to the company’s equity holders was 63.37 billion, an increase of 47.3% YoY. The company’s revenue growth this year mainly benefited from its expansion in the global and Chinese pharmaceutical markets and growth in major therapeutic areas, continuous development and commercialization of new drugs and product portfolio strengthening, effective control of costs and expenses, entry into medical insurance plans and participation in drug procurement competition in China’s public medical institutions.

Top 10 Holdings

This month, the Solactive Hong Kong Newly Listed Equities Index’s top ten holdings changed. DOBOT (2432.HK) fell out of the top ten holdings due to market fluctuations, while DUALITYBIO-B (9606.HK) became the new top ten holdings. The following industries are currently the focus of the index: industrials (including J&T EXPRESS-W, CATL, and DOBOT), consumer discretionary (including MIDEA, LEAPMOTOR, and MIXUE GROUP), and information technology (including HORIZON ROBOT, KINGSOFT CLOUD, and INNOSCIENCE). The following figures show the top 10 holdings and sector breakdown of the Phillip HK Newly Listed Equities Index:

Key Components Update

- TME-SW (1698.HK): Citigroup’s report is optimistic about Tencent Music’s latest music subscription plan, which balances the growth of net new users and average revenue per user (ARPU) and is committed to converting subscribers into super VIP members. It is a sustainable and resilient approach to ensure steady growth in music subscription revenue and improve profit prospects. Citi believes that Tencent Music’s stable and regular subscription model will continuously improve profit margins and form an entertainment ecosystem based on interaction between artists and fans in the future, which is highly consistent with the growing service consumption trend of young Chinese consumers.

- BEKE-W (2423.HK): Sheng Laiyun, deputy director of the National Bureau of Statistics, said at a press conference held by the State Council Information Office that since the beginning of this year, all regions and departments have implemented local policies and measures to stabilize the real estate market in accordance with the central government’s decisions and requirements. Statistical data show that the relevant measures have been effective. The overall real estate market is moving towards stabilization, as evidenced by a narrowing decline in commercial housing sales, improved funding sources for the real estate market, and orderly progress in debt reduction efforts by real estate companies. Real estate inventory has decreased for four consecutive months.

- J&T EXPRESS-W (1519.HK): J&T Express recently announced key operating data for the second quarter and first half of 2025. As of the second quarter of 2025, the company’s total parcel volume reached approximately 7.39 billion pieces, a year-on-year increase of 23.5%, with an average daily parcel volume of 81.2 million pieces. In the first half of 2025, the company’s total parcel volume reached 13.99 billion pieces, a year-on-year increase of 27%, with an average daily parcel volume of 76.9 million pieces. In the second quarter of this year, J&T’s business in the Southeast Asian market achieved strong growth, with parcel volume reaching approximately 1.69 billion pieces, a year-on-year increase of 65.9%, setting a record for single-quarter growth since the company’s listing.

- HORIZON ROBOT-W (9660.HK): In response to the trend of equal rights for intelligent driving at the beginning of this spring, in addition to Geely’s “Qian Li Hao Han”, many leading automakers’ high-end intelligent driving solutions, including BYD’s “Shang Di Zhi Yan”, have chosen to adopt the Journey series product solutions. Horizon Robotics can be said to be the “greatest common denominator” of automakers in promoting the trend of equal rights for intelligent driving and is the behind-the-scenes winner of the intelligent driving equal rights craze. Industry experts believe that Horizon Robotics is in a highly prosperous market for intelligent driving and possesses both scarcity and high growth potential. Driven by equal access to intelligent driving, its shipments are expected to increase significantly this year, making it the first Chinese intelligent driving technology company to achieve the 10-million-unit shipment milestone.

- CATL (3750.HK): According to CATL’s interim results report for the first half of 2025, released on the Hong Kong Stock Exchange, the company’s total revenue reached 178.9 billion yuan (RMB, the same below) in the first half of the year, a year-on-year increase of 7.27%, demonstrating steady revenue growth. Net profit during the reporting period increased significantly, reaching 30.5 billion yuan, a year-on-year increase of 33.02%, with particularly impressive performance. In terms of profitability, CATL’s gross profit margin during the reporting period was 25.02%, up 1.57% from the same period in 2024 to 44.8 billion yuan, a year-on-year increase of 14.45%, reflecting the company’s continued strengthening profitability.

Top constituent movers in July:

Bottom constituent movers in July:

The Phillip HK Newly Listed Index ETF (2835.HK) monthly performance for July

The Phillip HK Newly Listed Index ETF (2835.HK) recorded a 7.31% monthly increase in July, overperforming the Hang Seng Index’s (HSI) 2.91% monthly increase and the Hang Seng Tech Index’s (HSTI) 3.54% monthly increase. As of July 31st, this ETF had grown 22.40% since its listing, underperforming the HSI’s rose of 37.69% and the HSTI’s rose of 45.70%.